Moving Average Convergence Divergence

(MACD)

◙ Primary Use: Trend-Following Momentum Indicator

◙ Trading: Trading Signals from MACD Crossovers | Slope Divergences (important)

◙ Standard Settings: 12-period Fast, 26-period Slow, and 9-period EMA

![]() Introduction to MACD (Moving Average Convergence Divergence)

Introduction to MACD (Moving Average Convergence Divergence)

Developed by Gerald Appel in the 1970s, MACD is a trend-following momentum indicator and one of the most widely used technical analysis tools worldwide. This oscillator can evaluate the momentum of a trend and generate reliable trading signals.

-

The MACD is the difference between a 26-day and a 12-day EMA (Exponential Moving Average).

-

The Signal Line is a 9-day EMA that acts as a trigger for buying or selling.

-

MACD can be used for trading any financial market (Forex, Equities, Commodities) across multiple timeframes.

There are two main ways to use MACD:

(a) A 2-line system (MACD and Signal Line) that focuses on their interaction.

(b) The MACD Histogram, which highlights crossovers above/below zero.

The MACD Histogram

Developed by Thomas Aspray, the MACD-Histogram shows the distance between the MACD line and the Signal Line.

-

MACD evaluates price action, while the Histogram shows what MACD is doing.

-

The MACD-Histogram can be used as a signaling tool around the zero line (crossing above/below zero indicates a crossover).

-

The higher the histogram value, the stronger the price momentum.

-

MACD-Histogram divergences can indicate an upcoming MACD line crossover.

![]() Calculating the Moving Average Convergence Divergence

Calculating the Moving Average Convergence Divergence

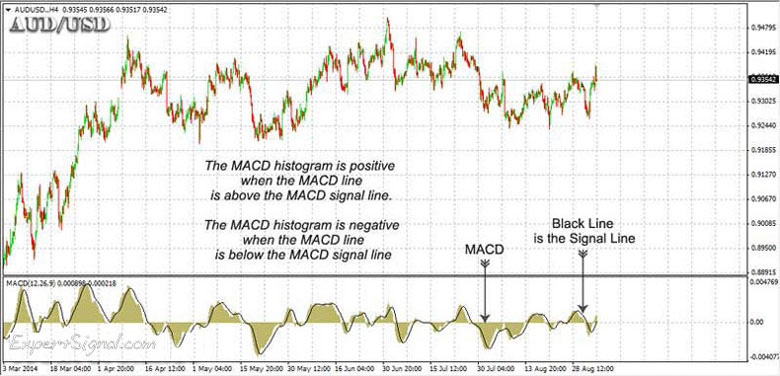

■ MACD Line = { Exponential Moving Average (12 periods) – Exponential Moving Average (26 periods) }

The MACD line is used as a measure of the convergence and the divergence of the fast and slow EMAs (Exponential moving averages)

■ Signal Line = { Exponential Moving Average (9 periods) of MACD Line }

The MACD signal line is used as an indicator of the directional change of the MACD line

■ MACD Histogram = MACD Line – Signal Line

The MACD histogram reflects the difference between the MACD line and the MACD signal line:

- The MACD histogram is positive when the MACD line is above the MACD signal line

- The MACD histogram is negative when the MACD line is below the MACD signal line

![]() Trading with MACD

Trading with MACD

MACD uses 3 moving averages, enabling it to analyze price momentum effectively.

MACD can be used for:

-

Identifying the trend

-

Evaluating trend momentum

-

Trading signals from MACD crossovers

-

Divergences between price and MACD slopes

-

Contrarian trading strategies

Timeframes

MACD works across multiple timeframes, excluding very short ones. Suggested timeframes include:

-

M15, M30, H1, H4, and D1

-

MACD signals are more reliable on H1 and H4 charts.

Evaluating The Momentum of the Trend

-

When the two MACD lines move apart → momentum is increasing, and the trend strengthens.

-

When the lines move closer → momentum is decreasing, and the trend weakens.

Trading MACD Line Crossovers

This is the simplest way to trade MACD:

-

(↑) Buy when the MACD crosses above the Signal Line.

-

(↓) Sell when the MACD crosses below the Signal Line.

→ Using the Histogram, a crossover above/below the Signal Line happens at zero (0).

![]() Key Tips When Using MACD

Key Tips When Using MACD

These are some key tips when trading with the Moving Average Convergence Divergence:

-

Avoid using MACD on timeframes below M15.

-

The MACD Histogram is more beginner-friendly.

-

MACD may not generate reliable signals during very strong directional trends.

-

Divergence signals are more reliable than crossover signals.

-

Divergences work better on H1 and H4 (use lower timeframes for entries/exits).

-

Always confirm MACD signals using price action techniques:

-

Support/Resistance Breakouts

-

Channel Breakouts

-

Volume Breakouts (Equities)

-

Candlestick Formations (Find more here about candles)

-

RSI on lower timeframes (e.g., H1 MACD with M15 RSI)

-

-

In trending markets, the MACD lines will move away from each other, while in ranging markets, the two MACD lines will come close to each other

-

Alternative MACD settings include: 8 | 17.5 | 9

![]() Platform Setup

Platform Setup

You can install the 'MACD' or'MACD HISTOGRAM' directly in MetaTrader-4 or MetaTrader-5:

(i) CLASSIC (2-LINE) MACD SYSTEM

□ GO TO → INDICATORS → OSCILLATORS → MACD

□ STANDARD SETTINGS → 12,26,9

(ii) MACD HISTOGRAM

□ GO TO → INDICATORS → CUSTOM → MACD HISTOGRAM

□ STANDARD SETTINGS → 12,26,9

■ The Moving Average Convergence Divergence

George Protonotarios, financial analyst

ExpertSignal.com ©

Read More at ExpertSignal » MACD » RSI » CCI » ADX » DeMarker » Awesome » Gator

■ COMPARE PROVIDERS

► Forex Accounts

► Trade Signals

► Crypto Exchanges

► Volume indicators

►Trend Indicators

■ OSCILLATORS

» INTRODUCTION

» Momentum

» RSI PRECISION